The country’s nutraceutical sector grew by about seven per cent last year, said Leni P. Olmedo, president at The Health and Dietary Supplement Association of the Philippines (HADSAP).

At the height of COVID-19, the sector grew at about nine per cent, and the momentum is not slowing down.

Growth of the sector has been “very robust”, said Olmedo, adding that the rate of increase was expected to stay at about five to seven per cent in the next five years.

"If you compare the growth of health and dietary supplements in 2023 versus the previous years, it has been very robust.

Last year, the industry grew by about seven per cent and prior to that, when we were still in the midst of the pandemic, we were growing by about nine per cent, so it's not slowing down.

The entire industry is projected to grow by about upwards of seven per cent or maybe it will maybe temper down a bit to about five per cent in the next five years."

Much of the growth was led by vitamin products – including single vitamins and multivitamins, which is also by far, the largest category in the country’s nutraceutical market.

Like many other countries, the nutraceutical sector is expected to continue growing in The Philippines because consumers are becoming more health conscious and are taking preventive measures.

However, post-COVID, Filipino consumers are paying more attention to weight management to shed off the extra pounds gained during the pandemic years.

Dietary supplement retailer and brand LAC also observed a greater interest in liver health and cognitive function.

While COVID-19 has popularised online or social commerce of dietary supplements in places such as China, the same cannot be said of The Philippines.

Traditional retailers are still the go-to channel for about 97 per cent of Filipino consumers when buying health supplements, said Olmedo.

LAC concurred, with the brand itself adding five more retail outlets in the past year to a total of 47 branches today.

This edition of VitamINSIGHTS will take a closer look into The Philippines’ nutraceutical market, including the trending categories, emerging categories and industry challenges.

The Philippines is also the fifth South East Asian market covered in our VitamINSIGHTS series, on top of Thailand, Malaysia, Singapore, and Vietnam.

VDS tops consumer health sector

Vitamin and dietary supplements, including single vitamins and multivitamins, is the largest consumer health category in the Philippines in terms of sales.

About 30 to 40 per cent of the country’s consumer health industry is made up of this category, said Olmedo, based on data from companies and the industry.

The rest of the consumer health industry is made up of over-the-counter medicines, paediatric health products, sports nutrition, weight management, herbal and traditional products etc.

“Based on the data I have, the topmost consumer health category is still vitamins and dietary supplements, which includes all of your single vitamins and multivitamins, along with a broad category of dietary supplements that addresses different issues within that category,” said Olmedo who is also the country manager of Amway Philippines.

Unilab, considered as one of the leading consumer health companies in The Philippines’, lists Forti-D, its doctor-prescribed vitamin D, as one of its bestsellers.

Others include its multivitamin product Enervon Z + Multivitamins + Zinc, which based on its product label, is for “healthy energy and stronger immunity”.

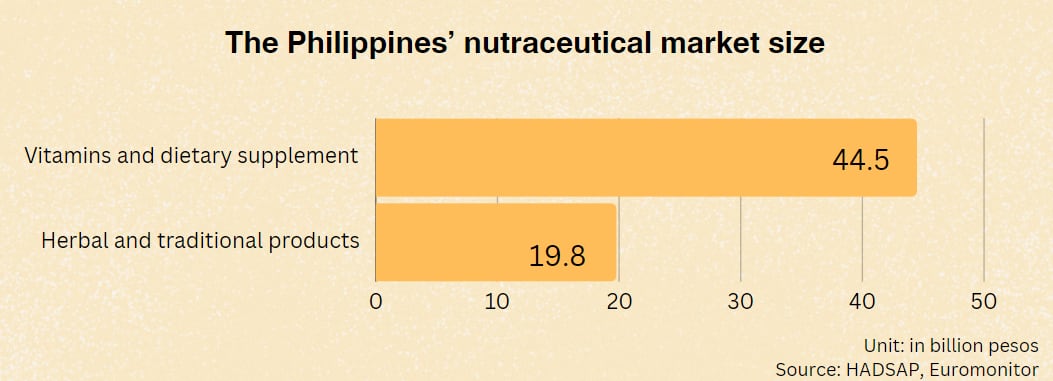

Citing data from Euromonitor, Olmedo said that the Vitamin and Dietary Supplement (VDS) sector was worth 44.5 bn pesos (US$2.2bn) and grew by about 8.1 per cent last year.

The second largest category was herbal and traditional products, which was worth 19.8bn pesos (US$996m).

One reason was because there is a preference among consumers for “natural and green” alternatives.

“I should say that the intake of vitamins and dietary supplements, particularly those that are natural in in terms of the greener alternatives, herbal and of course, traditional products are the ones that are actually growing in the market,” she said.

Watch the following video as Olmedo tells us more about the state of The Philippines’ nutraceutical market and the potential for emerging categories.

On the other hand, while categories such as probiotics has flourished in mature nutraceutical markets, it is still at a nascent stage in The Philippines.

Nonetheless, the growing use of probiotics for various purpose beyond gut health could propel the category to faster growth.

“I think probiotics is in the early stages of really trending, but we're seeing the rise in the usage of biotics.

“It's not yet a big category at this point, but it looks like based on what we're observing and based also from what our member companies are saying, their probiotics are gaining ground at this point...It’s not yet dynamic, but it's on the rise,” she said.

Weight management gaining traction post-COVID

Weight management is highlighted as a fast-growing health concern driving health supplement use especially in the past three years.

Part of the reason was because obesity rates have gone up during the pandemic years.

Findings from the Food and Nutrition Research Institute’s (FRNI) National Nutrition Survey in 2021 found that 40 per cent of the Filipino adults aged 18 to 65 were either overweight or obese.

“There was a huge rise in obesity in The Philippines during the pandemic, which I believe could be due to the lack of mobility, as people were advised to stay at home, working from home was the trend, and there was easy access to food delivery services.

“When people started going back to the office for work and started seeing people, of course they'll still want to look good and we saw that especially among the young people, physical aesthetics is still pretty much among their topmost priorities,” said Olmedo.

In this case, supplement nutrition drinks, including meal replacements, are the popular options for consumers.

This also means that palatability is a key consideration to ensure that consumers will follow through the regimen.

“Especially for food and beverage types of products, palatability is important, it has to be something that they can take in and being able to sustain on the weight management regimen in the long term,” said Olmedo.

At the same time, because herbal and natural ingredients are trending in The Philippines, she said that there is a likelihood that consumers would want to try these options for weight management.

“The preference for something herbal and natural is the trend here. Thus, if there's an option for consumers to do weight management using natural ingredients, I think that will become a more popular option, perhaps more so than the typical meal replacement products,” she said.

With more consumers concerned with their weight, the number of gym-goers and gyms have increased, and she believes sports nutrition is set to take off in the country as well.

Anytime Fitness, which runs 24-hour gyms, has for instance, opened its 150th outlet in The Philippines in August.

The Philippines, together with Malaysia and Singapore are also the three countries where it operates the most outlets.

Rise in liver and cognitive health

On the other hand, LAC has noticed that Filipino consumers are paying more attention to liver and cognitive health, which is also reflected in their bestsellers.

Currently, Liver Protector and BrainSpeed PS are among its second and third bestselling products in The Philippines.

Its flagship product, LAC Masquelier’s French Pine Bark Extract for antioxidative effects, is its top seller in The Philippines, similar as other markets that it operates in, including Singapore and Malaysia.

LAC, which stands for “Leader in Antioxidative Control”, belongs to Singapore-based company V3 Group. The company also owns TWG Tea, Bacha Coffee and OSIM.

Increased awareness on liver health, including liver-related diseases, could be one reason driving the uptake of LAC’s Liver Protector, said chief marketing officer Evelyn Teo.

“In the Philippines, liver-related diseases are becoming a concern for consumers. About 27.3 out of every 1,000 deaths were related to the liver,” Teo said.

“We highlighted the product last year during a media event and this product has gone on to gain a lot more traction.

“I believe the Filipinos are getting to know more about non-alcoholic fatty liver, or even general fatty liver.”

Liver Protector is formulated with a blend of Traditional Chinese Medicinal herbs, including Sanchi, turmeric, lotus leaf, hawthorn fruit, dodder seed, oriental waterplantain rhizome, and white peony root etc.

The product is said to “prevent and relieve fatty liver”, “maintain the functions of liver”, and “lower bad blood lipids.”

Another trend that Teo has noticed, is the interest in products such as LAC BrainSpeed PS that supports cognitive function.

The product contains phosphatidylserine, choline and is said to “sharpen mid and memory”, “support cognitive acuity”, and “optimise brain function.”

“Brain health is a product which you might not think is one of our best sellers, but it is. We are seeing the trend, partly because I think people really want to do well in what they are doing,” she said.

Offline retailers still mainstay in Philippines

Most of the Filipino consumers are still purchasing health supplements from traditional retailers, including supermarkets and health and beauty retailers, said Olmedo.

“I think the ability to look at all the products that are on the shelves, compare and all that is also something that's driving people to go for those types of outlets as compared to say for example, direct selling, where the only information that they’ll be able to see are whatever products that the distributor is providing,” she said.

Some up-and-coming brands, such as Australia’s Haircarebear has also chose to enter The Philippines through both online and offline channels.

Haircarebear specialises in functional gummies and Hair Gummies, formulated with biotin, vitamins and minerals, is its flagship product.

While its products are available via Shopee and Lazada, its largest partner in The Philippines is health and beauty retailer Watsons.

LAC, in the same vein, has been expanding its offline presence in The Philippines, which it believes is crucial in maintaining consumer engagement and advising consumers on the types of products to take.

LAC, which entered The Philippines less than 10 years ago, currently runs 47 outlets in the country, mostly in metro Manila.

Between 2023 till now, it has open five new stores in the country.

In total, LAC runs 220 stores in all the markets that it operates in, including Singapore, Malaysia, Taiwan, and Vietnam – also one of its newest markets.

Singapore and Malaysia are its top two biggest markets, while Taiwan and The Philippines are on par at the third place.

“In general, everyone wants something that’s personalised and that's why while the trend in the market is to shut down retail stores, our stores are still open.

“Customers will still come and speak to us for personalised solutions,” said Teo.

Challenges and opportunities

One of the challenges seen in The Philippines currently is the regulatory restriction around making health claims for food supplements.

“Right now, we are not supposed to make health claims for food supplements in The Philippines. No approved therapeutic claims exist in our labels for a food supplement product.

“However, the first thing you will look at is actually the product label, and having no ability to make health claims in the label is actually preventing us from providing good information to our to our customers,” said Olmedo.

However, she hopes that the ongoing ASEAN harmonisation could help remove the hurdle and adopt best practices on health claims that are currently not implemented in The Philippines.

She added that adopting the same guidelines through ASEAN would open more opportunities for Filipino supplement companies.

“A Filipino manufacturer only has access to about 100 million population and will have access to about 600 million population across ASEAN once harmonisation goes through, so I think that's the biggest opportunity,” she said.