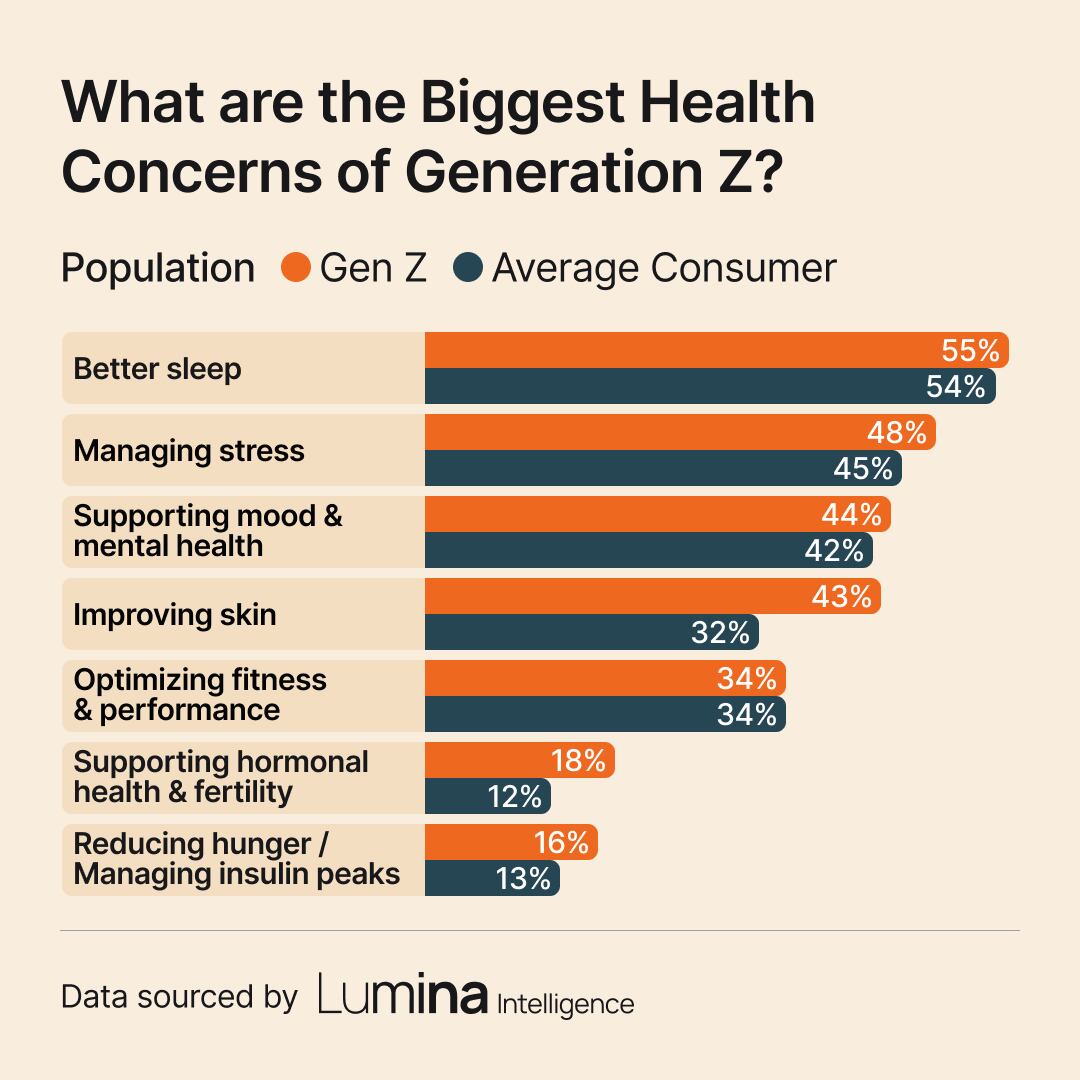

1. Better sleep, managing stress, and mental health support are at the top of the list for Gen Z consumers when it comes to their health.

Notably, Gen Z respondents shared the same attitude as the general population (34%) regarding optimizing fitness and performance as a top health concern.

For industry stakeholders, this could mean that brands should avoid overemphasizing high-intensity fitness narratives or performance-obsessed messaging for Gen Z audiences.

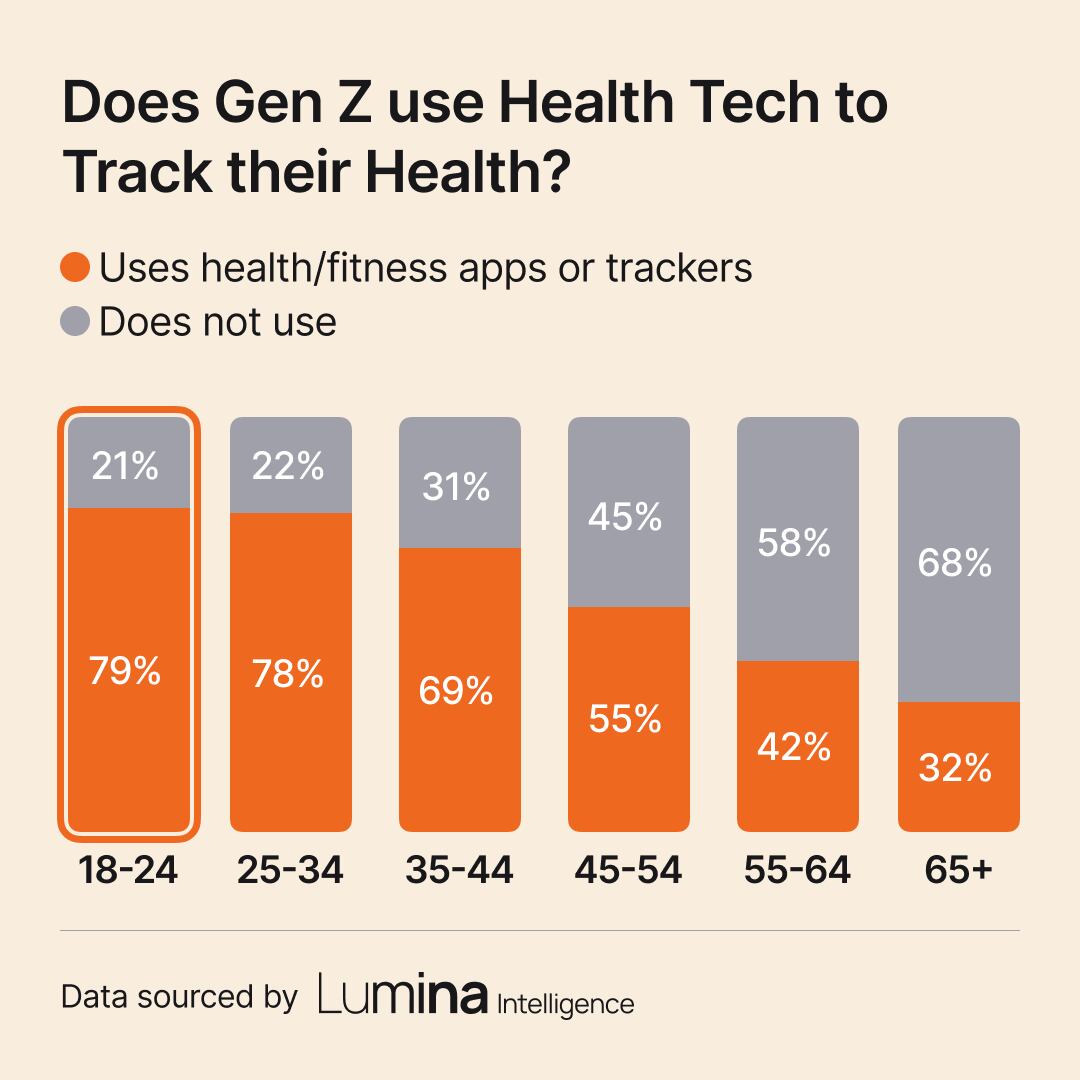

2. Unsurprisingly, Gen Z has embraced the advantages of health tech to monitor and better address health concerns closely.

Interestingly, Gen Z and Millennial respondents (aged 25-34) share almost identical usage of health apps and fitness trackers. Despite generational differences in other digital habits, these two groups share a strong commitment to managing their personal health through technology.

This parity could indicate a convergence of health priorities and tech savviness between late Gen Z and early Millennials, perhaps due to life stage similarities such as entering the workforce, starting families, or managing long-term wellness goals.

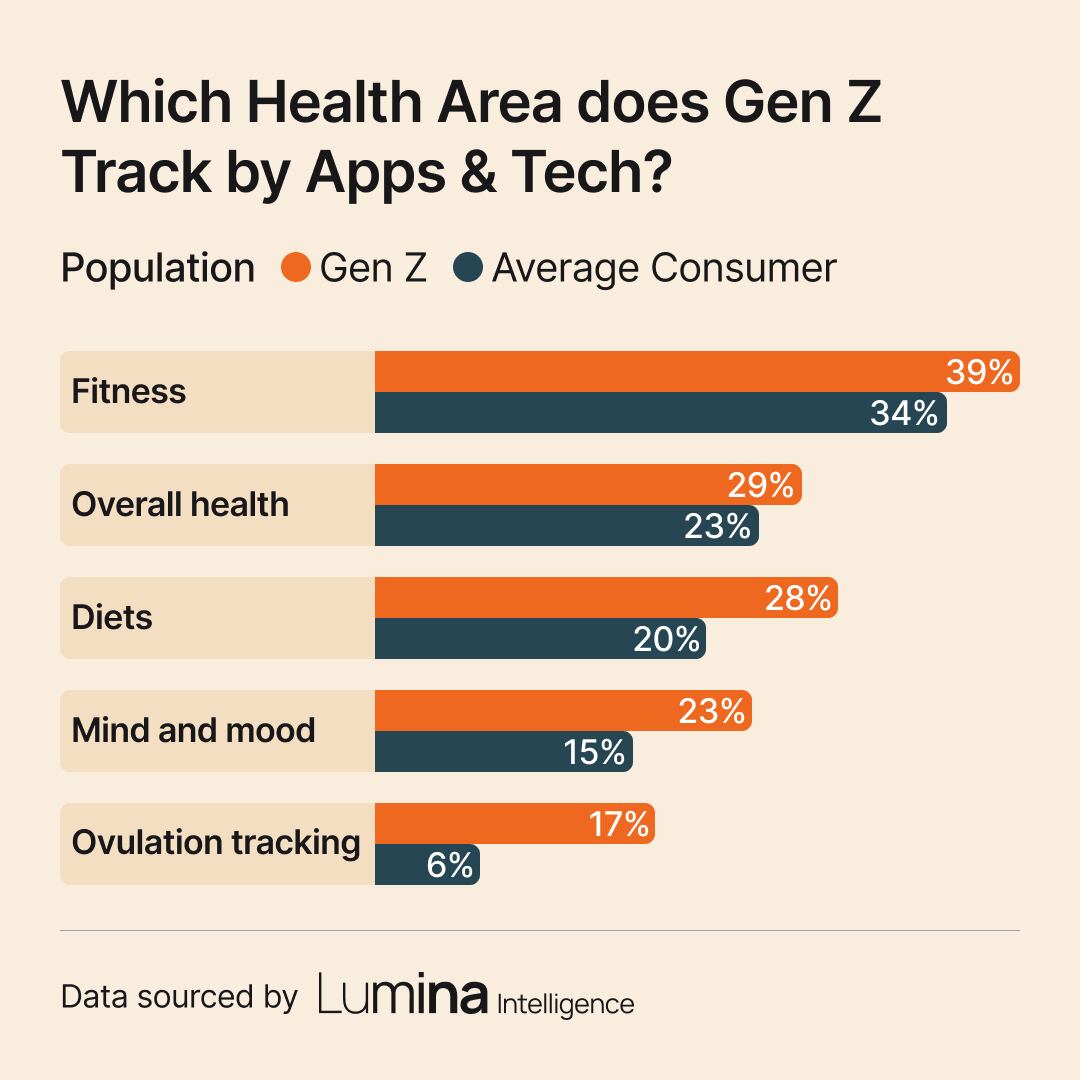

3. Apps and trackers are predominantly used to analyze Gen Z’s overall fitness, health, and dietary habits.

Interestingly, 17% of Gen Z respondents reported using health apps to track their ovulation (nearly three times the rate in the general population), which could signal a growing demand among younger consumers for products that align with their hormonal health, menstrual cycles, and reproductive wellness.

For industry stakeholders, this finding reveals a potential opportunity for education and innovation. Supplement brands and ingredient suppliers can stand out by offering smart, tech-integrated solutions or formulations that support cycle tracking, with science-backed transparency.

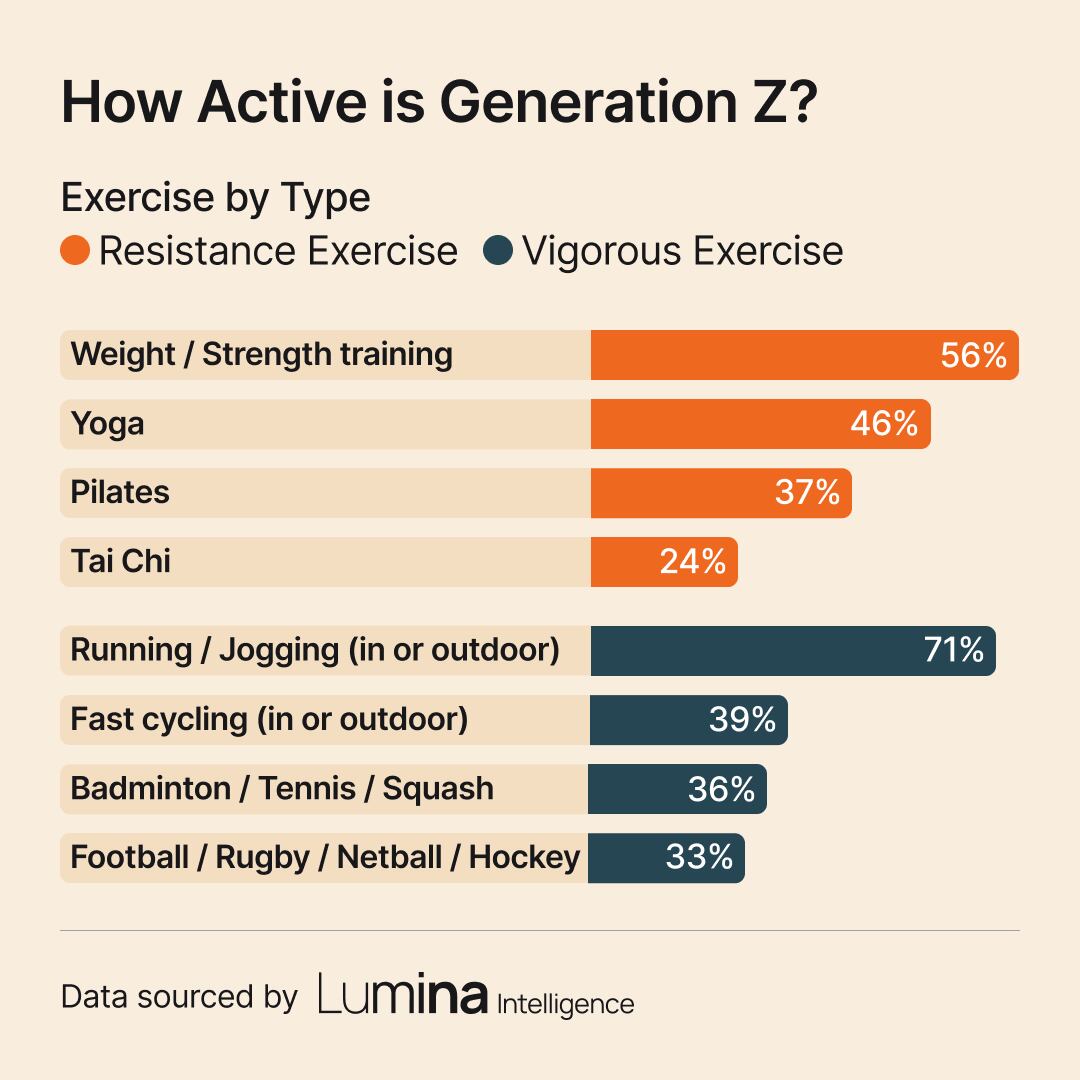

4. Getting the most out of those tracking tools means being active; over half of Gen Z respondents have embraced weight or strength training and running or jogging.

Gen Z’s fitness habits reflect a balanced blend of cardio and strength, driving demand for versatile, performance-supporting nutrition.

With 71% of Gen Z engaging in running or jogging and 56% participating in weight or strength training, this generation is not choosing one type of activity over another. They’re building well-rounded fitness routines that support both strength and endurance.

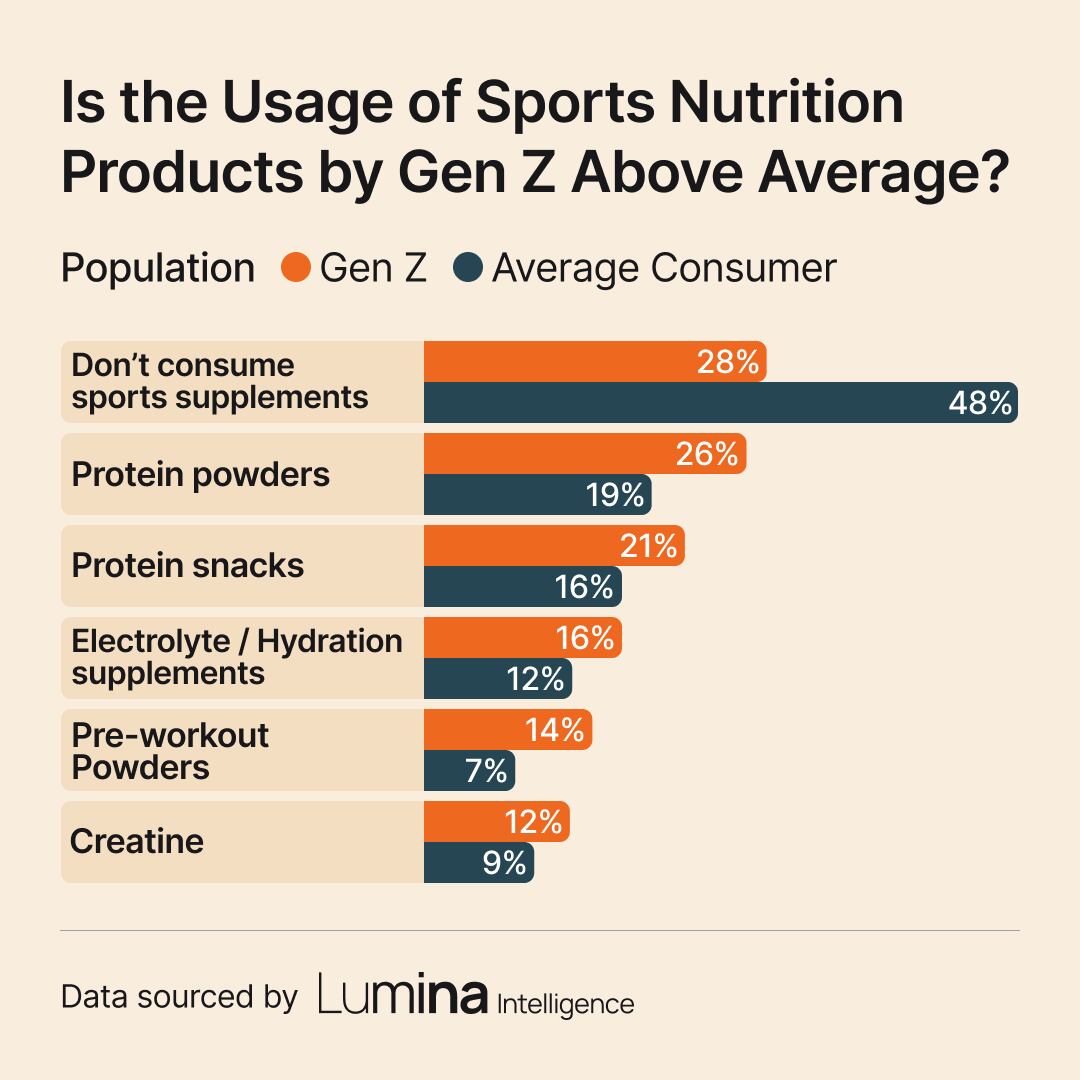

With nearly half (47%) of Gen Z consumers using protein powders or snacks, it’s clear that they are open to incorporating functional nutrition into their routines to support active, busy lifestyles—even if they’re not traditional athletes.

This trend signals a growing market for versatile, lifestyle-oriented sports nutrition products that cater to Gen Z’s values, such as sustainability, transparency, and personalization.