VitamINSIGHTS

South Korea: Nutra sector thriving despite economic slowdown as body fat reduction remains top concern

South Korea is considered one of the most robust nutraceutical markets in Asia-Pacific.

Data released by the Ministry of Food and Drug Safety (MFDS) in January showed that the volume of health supplements and functional ingredients imported into the country was up 20 per cent to 27,045 tons between 2022 and 2021.

The increase was largely driven by the import of complex nutrients, such as vitamins and minerals present in the country’s pre-approved notified list, as well as those that are individually approved on a case-by-case basis.

The retail market, on the other hand, has expanded by around 10 percent point between 2020 and 2021.

Citing statistics from the MFDS, it is expected to grow at eight percent point this year, said Dr. Frank Kim, founder of South Korean consultancy firm SEAH Bio Solutions which provides services for health supplement, pharmaceutical, processed foods, and cosmetics companies.

“Compared to the other industries, such as the general food or medicinal product or medical device or cosmetics, the dietary supplement industry is really doing good, so the growth rate, as compared to the other categories, is higher.

“That's very impressive, once the economic condition is getting better, I think the market growth rate will jump,” Dr. Kim said.

South Korea’s gross domestic product (GDP) was up 0.3 per cent in the first quarter this year – a rebound from the last quarter of 2022 where GDP was down 0.4 per cent.

In May, Reuters reported that the consumer inflation in the country had eased for the third consecutive month and even hit a 14-month low in April.

“As with many other industries, quite a few companies suffered in the health supplement industry. Small and medium-sized enterprises and large corporations recorded a decrease in sales, and profitability got worse.

“Nevertheless, according to the Korea Health Functional Food Association, the size of the domestic health functional food market (6 trillion won) in 2022 has grown by 8 per cent compared to the previous year,” said Myeong Hee Kim, founder and CEO of South Korean probiotic firm AceBiome – a subsidiary of biotechnology research firm Bioneer Corporation.

Nutraceuticals, or Health Functional Food (HFF) as they are known locally, have to be evaluated by the MFDS for safety and functionality before they are sold in the domestic retail market.

In this series of VitamINSIGHTS, NutraIngredients-Asia will take a closer look into the trending categories, consumer behaviour, and industry challenges that the nutraceutical sector in South Korea has seen.

Part I: Body fat reduction the ‘evergreen’ need, joint health demand growing

Body fat reduction is identified as the top consumer demand when it comes to nutraceuticals in South Korea.

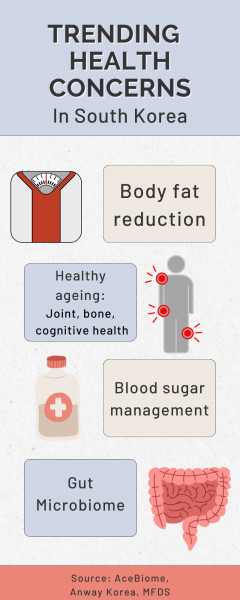

Together with joint and bone, eye care, cognitive, skin, liver health and blood sugar reduction, these are the seven key consumer concerns that have been trending in the country.

“This pattern is still the same as a couple of years back, so we don’t expect any challenge to the body fat reduction and joint care categories, which are the top one and two consumer concerns…The ranking is quite stable and I personally think that this trend will continue,” said Dr. Kim.

In fact, body fat reduction or weight management is a “traditionally trendy” category, which also means that companies would need to be quicker in their innovation to stay ahead of the game.

“Consumers are looking for new functional ingredients every year, so a shorter product life cycle is more challenging as compared to the other categories,” said Kim.

Kim’s company, AceBiome, is well-known for its weight management probiotics BNRThin containing the firm’s patented Lactobacillus gasseri BNR17 strain isolated from human breast milk.

Aside from body fat reduction, the company has also recently ventured into joint health – which it has identified as its second business focus – with the launch of AnaParactin in April. The product, however, does not contain probiotics, but is made of a patented extract of Andrographis paniculata leaves, vitamin D3, N-acetylglucosamine (NAG), and 10 other ingredients.

She pointed out that the joint health category has been fast-growing, especially since the MFDS has approved eight ingredients for joint health via the individually approved framework last year.

“The joint sector is growing steadily, and the market seems saturated with many joint health ingredients. Nevertheless, the development of new products continued, and among the ingredients individually approved by the MFDS last year, ingredients for joint health were the largest, with eight cases.

“This reflects the growth and demand of the joint market due to the ageing population,” she said.

To ride on the popularity of body fat reduction and joint health, her company has designed AnaParactin to capture consumers who are interested in both body fat reduction and joint health.

“AceBiome is interested in the continuously growing functional sector. Products offering body fat reduction function is one of them, and the joint health function market is another. However, this will also be the same for most health functional food companies.

“For us, the repeat customers experiencing the benefits of healthy weight and gut health [of BNR17] would be our target customers for AnaParactin. In other words, we see that we have a common customer group,” said Kim.

In the same vein, Amway Korea is also seeing consumer interest in the field of gut microbiome, driven by both immune health and gut health concerns.

“First, consumer interest in immune health has continued to grow in the wake of the COVID-19 pandemic, leading to the rapid growth of the gut health market focused on probiotic products.

“In Korea, the gut health is driving industry growth, and the complex gut health market, which encompasses products with added functionalities and ingredients, is rapidly gaining popularity among Korean consumers,” said Amway Korea’s chief marketing officer Eun-Ja Shin.

In addition, the firm has noticed a growing interest in basic physical fitness, particularly among the middle-aged and elderly population, which has resulted in significant growth in the protein, bone, and joint health sectors, often referred to as the “dumbbell economy”.

Along with this, the country’s ageing society has resulted in the rise of products catered to healthy ageing, including those designed to support blood circulation, managing blood glucose levels, maintaining eye health, and supporting cognitive abilities, said Shin.

As such, the firm has launched a supplement, known as Glyco Down, to assist in blood sugar management earlier this year, as well as protein food products in various formats, such as snacks, bars, and liquid.

“We also have plans to launch Omega-3 products with advanced Nutrilite's patented technology, as well as next-generation eye health products with strengthened antioxidant functionality,” said Shin.

On the other hand, personalised nutrition is an up-and-coming sector, with the government introducing sandbox or pilot trials and active involvement from big companies such as Amway Korea.

This year, the MFDS has even set up a project worth KRW$2.2bn (US$1.66bn) for local firms Log(me) Inc and Human Effective Microbes Pharma (HEM Pharma) to research and set up national guidelines for the personalised nutrition sector.

Part II: Red ginseng, vitamins, probiotics the three most popular HFF

Red ginseng is considered the ‘king’ of the South Korea’s HFF sector.

In 2021, it took the top spot in terms of production value, comprising 22.7 per cent of all HFF produced, pushing the category leader Korea Ginseng Corporation to the top spot in terms of HFF production volume. Probiotics and vitamins followed in the second and third place.

Kim said that red ginseng and vitamins were generally sought after for their immune health benefits while the probiotic market was crowded with me-too products.

“Numerous probiotics products have been released in recent years when probiotics have been attracting attention, but if you look at the market in 2022, a small number of companies with differentiating points continue to grow, products that are classified as general me-too products were affected by market changes.

“Only a few differentiated items have been growing, and many others appear to have gone through difficult times. In the functional probiotics market, premium dual-functional probiotic products continue to grow, led by the dual care product for weight management and intestinal health.

“AceBiome's body fat-reducing lactic acid bacteria, Lactobacillus gasseri BNR17 ‘BNRThin,’ recorded the most significant growth among probiotics companies, growing by more than 60 per cent as compared to year 2021,” she said.

She emphasised that providing differentiated functionality would be critical in a competitive market, as well as effective communication with consumers.

“A virtuous cycle structure would need to be created in which savvy consumers repurchase these products, new customers come in, and repeat customers increase. We believe that the weight management probiotic BNRThin business has grown with this model,” she said.

Watch the video as Kim shares more about the popular categories and how will AceBiome tap on the trends for further growth.

On the other hand, Amway Korea is integrating its probiotics products with diagnosis and lifestyle coaching services.

For example, the firm launched “my Lab by Nutrilite” that offers personalised microbiome probiotics last year.

“Within less than a year since launch, the solution has accumulated data from 35,000 consumers, the largest dataset of its kind collected by a single analysis institution in the world. In the future, more in-depth analysis based on this data will be conducted to help enhance customers’ lifestyles.

“We focus on the fundamental question, ‘How can we help people live healthier lives?’ rather than simply making products. Amway Korea provides customers with holistic solutions that integrate diagnosis, lifestyle coaching, and products,” said Shin.

According to a report by local search engine Naver, which also runs a same name shopping site, BNRThin was one of the most repurchased probiotics in South Koreans in their 40s to 50s.

The same report also found that omega-3, vitamin D, and biotin were the most searched health supplements online between January 2022 and February.

Part III: Popular shopping channels and changes in volume purchased

Consumers in their 50s generally prefer to purchase their HFF via TV home shopping, while those in their 20s to 40s prefer to do so online and ‘live shopping’ gaining consumer interest.

As much as TV home shopping is popular, Kim said that it would not be easy for companies to make a profit in this channel due to the high costs of participating in these shopping programs.

On the other hand, social networking service (SNS) group purchase on channels such as Instagram, is popular among consumers in their 20s to 30s, said Kim.

“Offline retail is reviving post-COVID, but the online market is still growing with consumers accustomed to being online through the COVID era.

“The group purchase sector continues to grow, and the sellers are achieving significant revenue through their personal SNS broadcasts,” she said.

An exciting change, she said, was the rapid growth of the ‘live shopping’ or livestreaming shopping channel.

“Following Naver Shopping Live’s lead, several online channels such as Kakao and Coupang introduced live shopping, and they are growing rapidly through broadcast marketing.

“It seems that young consumers are purchasing health functional foods through this channel,” she said.

On the other hand, ever since COVID-19, she noticed that consumers have reduced the volume for bulk purchases but were still spending considerably on supplements.

For example, on the TV home shopping channel, she said that the firm’s bestselling used to be the 12-month BNRThin Pro package.

However, in the past 2.5 years, consumers are switching to the nine-month package instead as they tighten purse strings.

“That's what we observed and automatically, we interpreted it as people are hesitant in spending large amounts of money on purchasing supplements. They need the product but at a lower price in terms of the total purchase amount,” she said.

Amway Korea also noticed that inflationary pressures have affected consumer spending and companies have been competing for spenders by slashing prices and giving steep discounts – despite rising manufacturing costs.

“Amway Korea aims to maintain the premium brand image of Nutrilite while also considering a diverse portfolio with reasonable price ranges to alleviate consumer burdens.

“At the same time, Amway Korea strives to differentiate customer experiences through personalized solutions like “my Lab by Nutrilite” and the metaverse exercise platform 25 Cent Ride to help them establish healthy lifestyles,” said Shin.

Part IV: New foreign brands could fight for a slice of the market via CBEC?

The South Korean HFF market is dominated by local firms such as Korea Ginseng Corp and CKD Bio, but still, foreign brands, especially direct-sellers have found success, and new players could try to penetrate the market via cross-border e-commerce (CBEC), said Dr. Kim.

“A lot of the global nutraceutical brands are trying their best effort to enlarge their market share in South Korea, but still, in terms of the marketing channel, it’s still led by the multi-marketing or direct-selling companies, like Amway Korea, Nuskin, and Usana Health Science.”

A report by Euromonitor last October showed that direct selling continued to play “an important but declining role in vitamins”. Amway Korea was the overall category leader last year and had launched new products such as N by Nutrilite to target the millennials.

“I think for the brand companies, they can approach other channels, such as CBEC.

“Although CBEC is supported by individual consumers buying personal purchase, the market size of CBEC has been increasing every year and I think many global brands are trying CBEC, because they are free from the quarantine and customs clearance which would be required if the products are brought in by a Korean importer,” Dr. Kim said.

In fact, he believes that more international companies will try to enter South Korea’s market via CBEC on Coupang, Naver, 11Street or other platforms in the next few years.

Once the companies are satisfied with the sales results from CBEC, then they could perhaps proceed with working with a Korean distributor or work via a local legal entity, he said.